We don't often see Communist China give up a piece of its sovereignty, still less so to "obscure market forces." Yet that's what's happening now with the remarkable development Beijing has initiated regarding the status of its currency, the Yuan.

Three weeks after putting an end to the fixed rate regime against the American dollar, China is entering a new stage by announcing that from now on the Yuan's value will be determined in relationship to major currencies. The Chinese currency's fluctuations will certainly continue to be narrowly controlled by the Central Bank, but we can see very clearly where the wind of history is blowing.

After accepting the rules of international trade and having observed the benefits it could derive from liberalization of exchanges, China decided to normalize its financial relations with the world. Taking into account its weight in the world economy, this normalization generates upsets at least as significant as those produced the last several years by China's penetration of global markets.

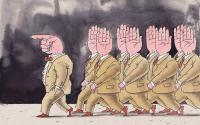

For ten years, China has, in effect, had an "arrangement" with the United States. In exchange for a fixed exchange rate between its currency and the greenback, massive Chinese capital flows have streamed into Wall Street. Beijing became one of the primary purchasers of American debt, thus filling in the United States' considerable budget deficit. It's in large part thanks to these capital flows that the Bush Administration has been able to finance the Iraq war without the least consequence to its credit conditions.

Washington's dependence on its "Chinese banker" has not escaped the notice of American leaders, some of them finding it a worrying loss of sovereignty. But it has allowed the US to maintain a very low interest rate on debt. It's in that sense that one could say American interest rates, like t-shirts or toys, are "made in China."

We can measure what the end of this monetary "arrangement" could mean for the millions of American households that buy their house or their car on credit: higher monthly payments, a less prosperous life-style. The developed countries of Europe could be affected in turn by a boomerang effect.

It seems unlikely that China would allow its currency to float freely at any time in the near future. The liberalization to which it has committed has expressed itself, for the moment, only in a very small revaluation of the Yuan, inadequate to relieve western industrialists in direct competition with the "world's factory." The weak Yuan, like the weak Yen during the 1970s, continues to procure a significant advantage for Chinese exporters.

But it would be a mistake to want to precipitate the float, taking into account the upsets it could provoke for the financing of the American economy. The White House has understood that well and has dissociated itself from the anti-Chinese speech in fashion with Congress's "hawks." It's never good to fall out with one's banker.

Translation: t r u t h o u t French language correspondent Leslie Thatcher.