23 May 2008Stephen Foley

In France, fishermen are blockading oil refineries. In Britain, lorry drivers are planning a day of action. In the US, the car maker Ford is to cut production of gas-guzzling sports utility vehicles and airlines are jacking up ticket prices. Global concerns about fuel prices are reaching fever pitch and the world's leading energy monitor has issued a disturbing downward revision of the oil industry's ability to keep pace with soaring demand.

Yesterday's warning from the International Energy Agency sent the price of a barrel of oil to a new record for the 13th day in a row. The latest high – $135 for a barrel of light sweet crude – was reached in New York barely five months after the price hit $100. Experts in London and on Wall Street predict that prices will rise to $200, regardless of the protests of consumers and the complaints of politicians. It is simple economics, they say: supply and demand. The former is short, the latter growing.

Consumers are feeling the pinch in almost every area of their daily lives. The pain is felt most obviously at the pumps. In Britain, the price of petrol has risen to an average of 114p for a litre of unleaded – £5.15 per gallon. In the US, where drivers pay much lower prices, gasoline is more than $4 (£2) a gallon. Beyond that, energy bills are rising for households across the globe, hitting the poorest the hardest. British Gas, the nation's biggest gas and electricity supplier, is mulling further price rises, on top of the 15 per cent average increase it introduced in January.

Airlines which once limited fare increases to temporary "fuel surcharges" are now raising ticket prices and – as American Airlines did this week – starting to charge for checked baggage. Meanwhile, manufacturers are putting up the price of goods to compensate for higher energy bills at their factorues, ending many years of price deflation that began when firms started transferring production overseas.

"The high-priced energy environment is being driven by the fact that demand has outstripped supply," President George Bush's Energy Secretary, Samuel Bodman, told the US Congress yesterday. "We have sopped up all the available spare oil production capacity in the system ... and there is no silver bullet that will immediately solve our energy challenges or drastically reduce costs at the gas pump."

The world uses about 87 million barrels of oil a day, about a quarter of it in the US. Saudi Arabia is the only country thought to have the capacity to pump oil faster. Meanwhile, China is in the throes of an industrial revolution that demands ever greater supplies of crude, yet global production has stagnated for two years. The Saudi government rejected a recent appeal from Mr Bush to increase production, saying there were no oil shortages at present. Economists worry, though, that shortages are around the corner, as mature oilfields wind down.

The Paris-based International Energy Agency (IEA) said yesterday that it might have overestimated the capacity of oil-producing nations to open new fields to keep up with growing demand over the next decade. Global production, which the IEA previously reckoned could reach 116 million barrels a day by 2030, might not even make 100 million.

Fatih Birol, the IEA's chief economist, said the oil industry had entered "a new energy world order" where it was harder to keep supply and demand in equilibrium. "When the price went up as a result of the Iranian revolution, demand went down," he added. "But what has happened in the last few years has not been in line with economic theory. The price of oil went up sharply between 2004 and 2006 and demand actually increased. That may seem bizarre but it is the result of new buyers coming in, such as China and the Middle Eastern economies where fuel is subsidised by government and rises are not reflected on the consumer side."

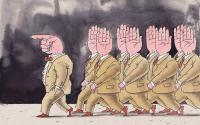

Some politicians in the US rail against nationalised oil companies in the developing world for failing to invest in new production that might alleviate stresses in the market. And at every turn, Mr Bush and members of his administration insist that environmentalists should yield to the public hunger for oil and Congress should authorise drilling in the Arctic National Wildlife Refuge in Alaska.

However, the investment bank Goldman Sachs said this month that the oil price could rise as high as $200 over the next year and would remain consistently above $100 until there was a significant fall in US demand. There are small signs of that happening. Yesterday, Ford said it was cutting vehicle production by more than it announced earlier this year. It will make the deepest cuts in its SUV and pick-up truck businesses because US customers are increasingly switching to lighter, more fuel-efficient vehicles. Alan Mulally, the chief executive, said pick-up sales now accounted for 9 per cent of the market compared with 11 per cent a few weeks ago.